In this article:

More than 2 million Aussies own an investment property, in a housing sector worth an estimated $6.5 trillion – or more than three times what we own in superannuation*.

There’s no one-size-fits-all profile of an investor – I’ve had everyone from teachers and nurses to tradies and business owners secure their financial future through investments.

With so many options for investing your money, so why is property so popular?

There are many reasons, both financial and emotional. People like investing in something they understand – everyone lives in a property, so you know what makes a good one. You can see, touch and perhaps even drive past the asset you own. Compared to shares or bonds, for example, bricks-and-mortar can give you a sense of security.

But there are also hard financial reasons, and if you know these three basic principles of property investment, you’ll understand why Aussies have a love affair with this sector.

Know the Power of Leverage

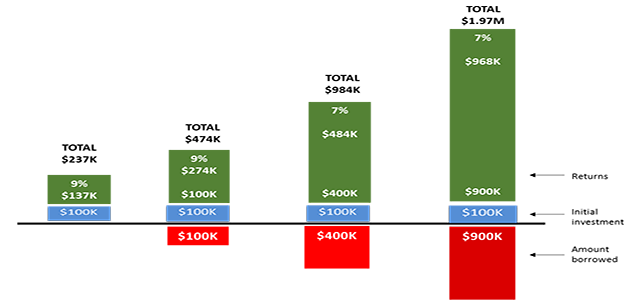

This means that the money you borrow to invest can increase the return you make. If you invest $100,000 of your own money and make 9% compound annual return over 10 years, you’d end up with $237,000 in total.

If you started with the same amount, but borrowed another $100,000, you’d make 9% on each $100,000 – so the final amount would be $474,000. Now, you’d have to subtract the cost of the interest from that, but you can see that there is still a significant difference.

If you keeping going with this idea, and look at borrowing $400K or $900K, the returns are bigger again – even with a lower rate of return (shown here as 7%). Of course, the interest costs would also be higher, but you’re still coming out ahead.

This is a simple example with lots of assumptions, including the return you’re making, but it paints the picture for you – borrowing to invest could upsize your returns.

A quick note – borrowing can also magnify your losses if things go wrong, so you should always talk to a professional and make sure you’re managing risks sensibly.

Figure 1. Leveraged return scenarios*

Understand the Magic of Compounding

Time is an investor’s friend. The earlier you start to save and invest, and the longer you hold an asset, the greater the return. That’s because the returns pile up on one another. Say you’re earning 5% on $100, you’d receive $5 – taking you to a grand total of $105.

But the next time you get that 5%, you’re earning it on top of that bigger amount of $105, so you receive $5.25 – giving you $110.25.

Sure, $10.25 cents doesn’t sound that big. But translate that into a $100,000 investment, and you’ve now made $10,250.

Over time, the effect is impressive and it’s what builds long-term wealth.

Know your numbers

Of course, all of these are simplified calculations. There are a range of costs associated with property investment, so it’s crucial to be clear about what they are. These range from the cost of interest on a loan, to maintenance costs for the property itself, through to the cost of tax on any profit you make.

On the flip side, there are tax concessions available, such as depreciation and negative gearing, which can positively affect the return.

It’s vital to run all of these numbers before you make a decision, and a good adviser will sit down with you to help you do just that. They will also help you find the best possible deal for financing the loan.

* Source: CoreLogic Profile of the Investor survey

** Assumptions: 7% or 9% compound annual return. Returns shown are before interest and costs.

Disclaimer:

The information provided is general in nature and cannot be construed as financial advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Consider your own goals, needs, objectives and financial situation before making a financial decision. You should read the Product Disclosure Statement (PDS) and obtain independent legal and financial advice.

Home loans and other credit services are provided by Credit Representatives of Yellow Brick Road Finance Pty Limited ACN 128 708 109, Australian Credit Licence 393195. Financial Advice, Insurance, Superannuation and other financial services are provided by Authorised Representatives of Yellow Brick Road Wealth Management Pty Limited ACN 128 650 037, AFSL 323825.

Contact Us

Contact Us Find a Broker

Find a Broker